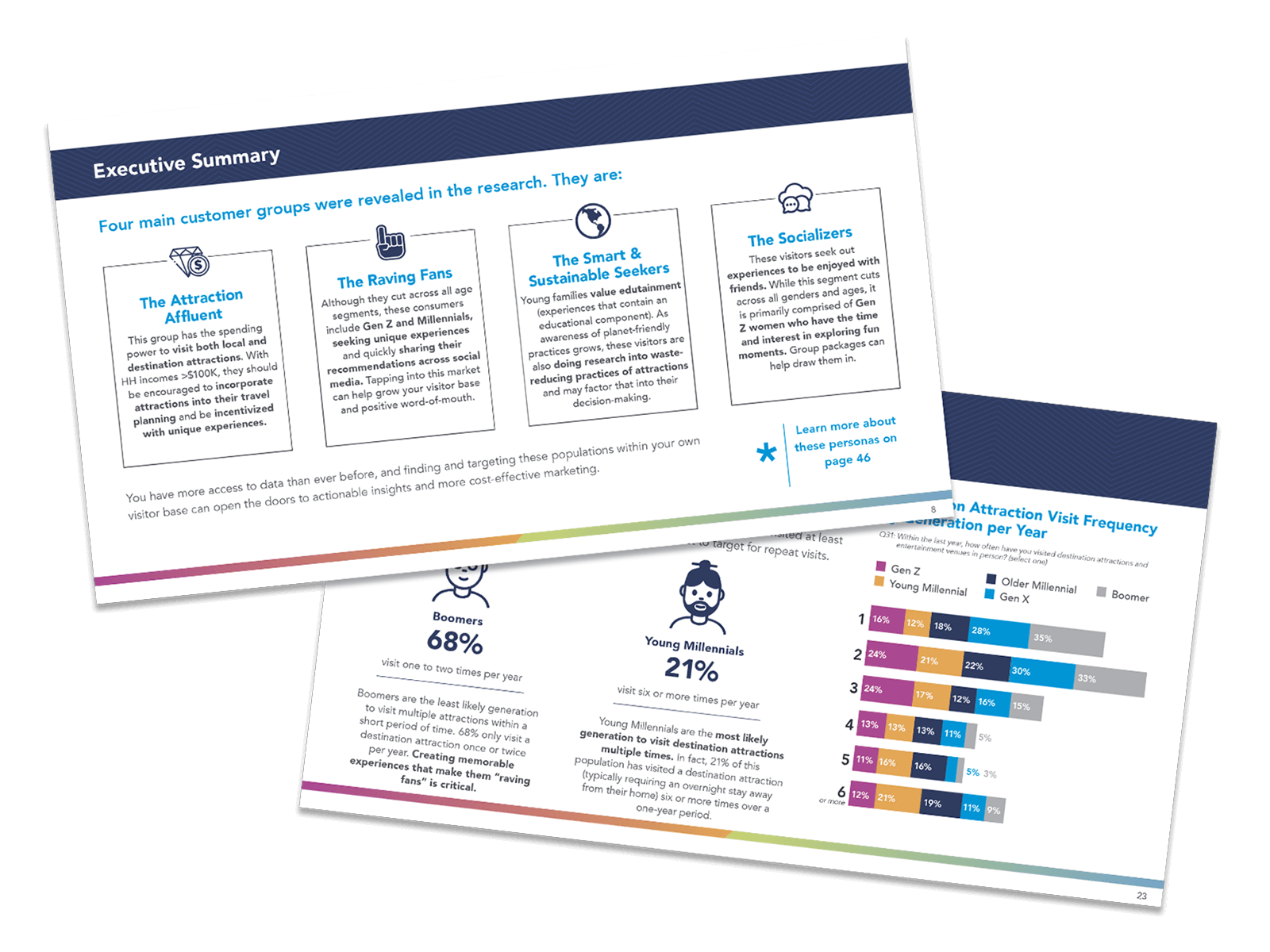

Visitor expectations around attractions have changed significantly, influenced by the pandemic, demographic shifts, and labor market changes. To understand these shifts, we partnered with IAAPA for a U.S. national study of 1,497 visitors across four generations.

Key findings include:

There is a great opportunity for attraction operators to improve the visitor journey across generations. We’ve identified the most impactful insights that executives, marketers, and guest experience professionals at attractions or entertainment destinations with operations in the U.S.

The report takes an in-depth look at several areas, including:

We decided to survey visitors across all generations to see how each audience compares and how operators should uniquely cater to each group. The audience segments include:

.png)